Unmatched Feature-Set

Total Integration

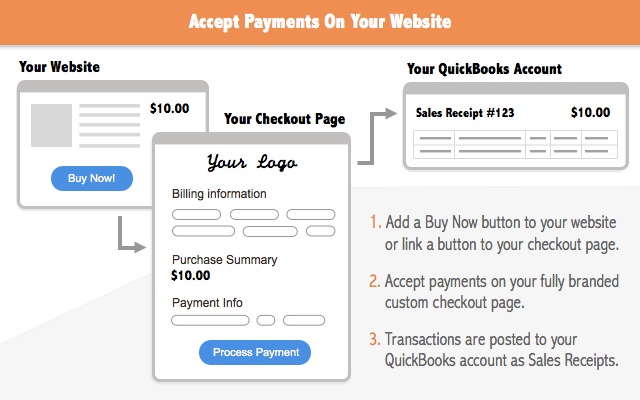

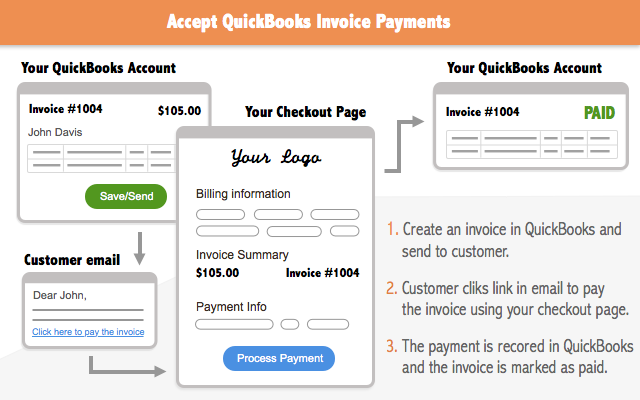

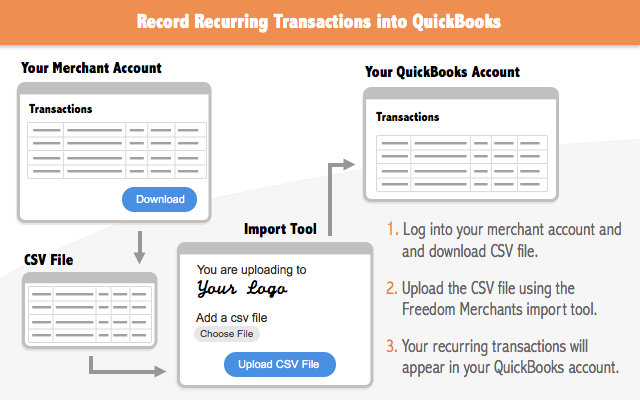

We create your Mobile-Friendly, Brand-Friendly, customized Checkout Page. Your customers enter their payment information. The individual transaction details and all relevant fields are AUTOMATICALLY loaded into your QuickBooks Online account.

Zero-Duplicate Data Entry

You will completely eliminate one of the biggest headaches and time-sinks that your bookkeeper, controller, business-owner, or CFO has with your growing e-commerce business: Duplicate Data-entry into your QuickBooks Online system.

Direct Revenue-Bucket Assignment

The ONLY solution in the country that can intelligently map your payments into the APPROPRIATE revenue-bucket in your QuickBooks, based on your needs. We can assign anywhere from 1 to hundreds of different revenue-buckets which will save dozens of hours monthly in manual re-classification.

End-Customer Surcharging Option

The only tool in the QuickBooks App universe that enables you to effortlessly turn on End-customer CC-surcharging and suppress it for Echeck/ACH. Automated proper accounting treatment of the Surcharge-income into your Chart of Accounts.

Best Pricing (US Version)

Only USD $30/month for Invoicing, Ecommerce, Recurring Billing, Website-integration, a Branded-Checkout Page, Merchant-Account, PCI handling, Virtual-Terminal, Echeck/ACH option, the App and much more. To save HOURS in data-entry and thousands of dollars per month.

Co-Synchronous Data-Flow to Other Software

While we send the individual transaction data to QuickBooks Online, we SIMULTANEOUSLY send relevant data to other software tools you may be using such as MailChimp, ConstantContact, InfusionSoft, SalesForce and many other programs.

Freedom Merchants

Intuit Merchant

1.10% Non-Qualified Surcharge (a)

+ $0.15/txn

(+ $0.25 per txn)

(QuickBooks Online)

(Both Payment types or just CC or ACH)

(Pay as you go is free with a higher CC %)

(a) Qualified rates apply to Consumer cards and also to some Corporate cards. Non-Qualified rates typically refer to Corporate cards, Foreign cards, Government cards, and other types of specialized cards that have a higher risk profile to their Issuing Bank than a basic Consumer credit/debit card. As a merchant, it's impossible to know ahead of time what category a card will fall into. Your monthly effective rate will be some mixture of Qualified and Non-Qualified rates depending on your customer base.